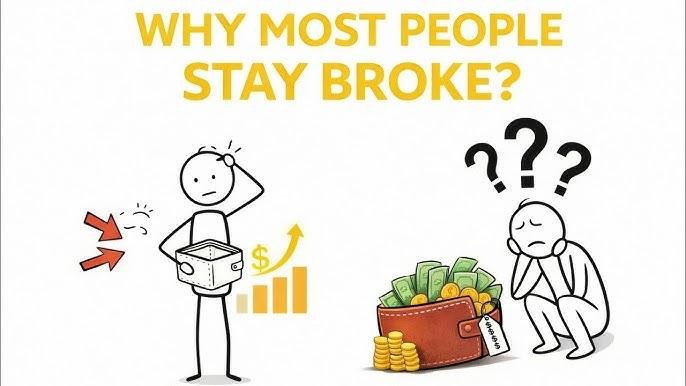

The Real Reason Most Young People Stay Broke (It’s Not Spending)

When money is tight, the usual advice shows up fast: “Stop spending so much.”

Cut coffee. Avoid outings. Live minimally.

But here’s the uncomfortable truth—most young people aren’t broke because they spend too much.

They’re broke because of something deeper and more structural.

Spending Is Visible. The Real Problem Is Not.

Spending is easy to blame because it’s obvious. You can see where money goes.

But many young people already:

-

Budget carefully

-

Avoid luxury lifestyles

-

Live modestly or with family

-

Delay personal goals

Yet they’re still broke.

That’s because you can’t save your way out of low income.

The Core Problem: Low Earning Power

The real reason many young people stay broke is limited earning leverage.

Most are stuck in systems where:

-

Income is fixed

-

Raises are slow or uncertain

-

Effort doesn’t scale

-

Time is the only asset sold

Even perfect discipline can’t overcome an income ceiling.

Time-for-Money Is a Trap

When income depends entirely on hours worked:

-

Missing work means missing pay

-

Growth is capped

-

Burnout is common

-

Financial stress never fully disappears

This model worked when costs were low and jobs were stable.

It’s failing in today’s economy.

Education Didn’t Teach Monetization

Many people learned:

-

How to pass exams

-

How to follow instructions

-

How to seek employment

But not:

-

How to create value

-

How to price skills

-

How to earn independently

-

How money systems actually work

This gap keeps people financially stuck—even when they’re intelligent and hardworking.

Another Silent Killer: Waiting Culture

A lot of young people are waiting:

-

For the “right job”

-

For promotion

-

For government support

-

For permission to start

Waiting feels safe—but it quietly drains years of earning potential.

What Actually Changes the Financial Equation

1. Increasing Income, Not Just Cutting Costs

Cost control helps—but income growth changes lives.

Focus on:

-

Skills that pay globally

-

Digital and remote opportunities

-

Side projects that can scale

2. Leverage Over Hustle

Working harder has limits. Leveraged systems don’t.

Examples:

-

Content that earns repeatedly

-

Digital products

-

Referral and affiliate systems

-

Platforms that reward contribution

Leverage turns effort into assets.

3. Learning How Money Moves

Wealth is less about saving and more about:

-

Cash flow

-

Value creation

-

Distribution

-

Systems

Understanding these shifts your decisions permanently.

The Truth No One Likes to Admit

Most young people aren’t irresponsible.

They’re under-earning in a high-cost world.

Blaming spending hides the real issue and delays real solutions.

Final Thoughts

Yes, discipline matters.

Yes, budgeting helps.

But the real escape from being broke comes from:

-

Increasing earning power

-

Building scalable income

-

Owning skills and systems

-

Stopping the wait-and-hope cycle

Stop asking only “How do I spend less?”

Start asking “How do I earn more—smarter?”

Because broke is rarely a spending problem. It’s an income and leverage problem.